On a windy afternoon off the coast of Italy, a 200 MW wind farm hums steadily. Yet the real story is not in the spinning blades but in the invisible systems behind them measuring every avoided kilowatt-hour, verifying every moment of grid stability, and recording each decision that extends the asset’s life. In the traditional model, these achievements rarely appear in financial statements. In a new model, they could be monetised directly.

The energy transition is often framed around the technologies we build: more wind farms, more battery storage, more interconnectors. But the next frontier may lie in how we value and monetise the performance of what we already have. This shift would transform asset management from a defensive discipline to a proactive engine for revenue, resilience, and sustainability.

Background: Why the Current Model Falls Short

Asset management in the energy sector has historically been concerned with reliability, life extension, and cost control. This focus is essential, but it is also narrow. Exceptional resilience under stress is not rewarded. Preventing an outage through predictive analytics does not create a new line item in revenue. Sustainability reporting is often a compliance exercise rather than a core driver of valuation. In effect, we manage assets to keep them running, not to make them more valuable.

Three Linked Innovations for the Future

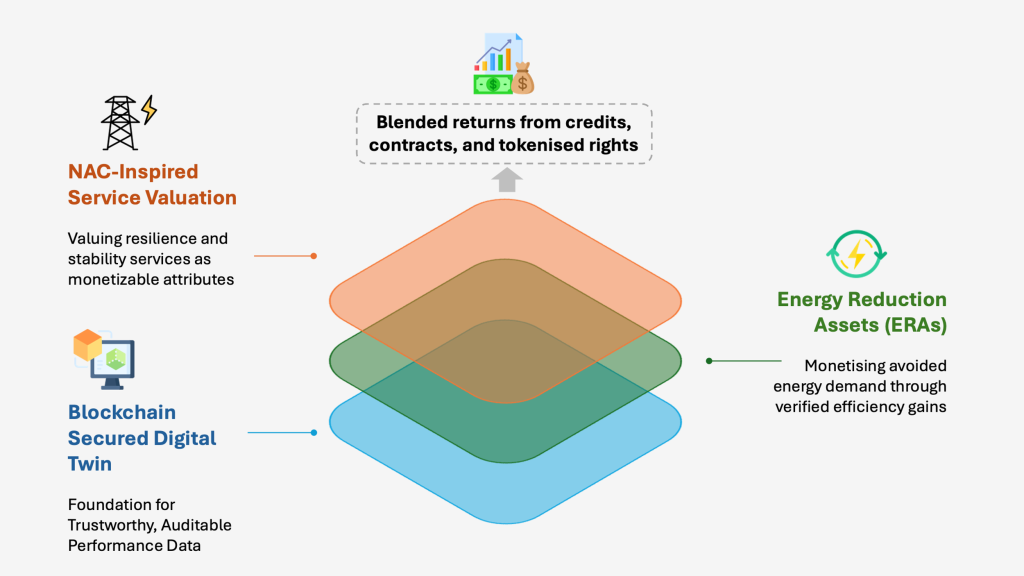

The emerging vision for energy infrastructure rests on three linked innovations that work best together.

First, Energy Reduction Assets (ERAs) create a financial value for energy efficiency. Think of ERAs as “white certificates 2.0”: instead of generic offsets like carbon offsets that compensate for emissions elsewhere, ERAs monetise measured, metered demand reduction at source against an agreed baseline. Precedents exist; Italy’s White Certificates scheme (Titoli di Efficienza Energetica) obligated distributors to meet quantified efficiency targets and certified millions of toe of primary energy savings, demonstrating that verified efficiency can be traded at scale. For instance, if a city upgrades its street lighting to ultra-efficient LEDs, the verified difference between baseline and actual consumption can be packaged into ERA credits and sold. This is a direct reward for reducing demand, not a balancing act for emissions produced elsewhere.

Second, blockchain-secured digital twins provide the verification backbone for this model. Digital twins are virtual replicas of physical assets that already help operators optimise maintenance and performance. Digital twins are moving from pilots to a real market: estimates place the global digital twin market at ~USD 25B in 2024, with projections above USD 150B by 2030, driven in part by energy and utilities use cases. When paired with blockchain, their data becomes tamper-proof and auditable in real time. This ensures that ERA credits or other performance-linked revenues are backed by trustworthy records, accessible to regulators, investors, and insurers without dispute.

The consequences of underinvesting in modern energy infrastructure are already visible. In the first half of 2025, Scottish wind farms were forced to curtail 37% of their potential output, with operators compensated to switch off, a decision that ultimately cost UK households an estimated £810 million. Across the wider UK, almost 10% of wind generation was curtailed in 2024, rising to 30% in Northern Ireland, due to grid capacity constraints. This is clean, low-cost energy being wasted, not because the technology failed, but because the supporting infrastructure could not keep pace. Effective asset management coupled with valuation models that reward resilience and performance, such as Energy Reduction Assets could transform these losses into measurable, tradable value streams that incentivise timely upgrades rather than payouts for wasted potential.

Third, NAC-inspired valuation reframes infrastructure as a provider of ongoing services rather than as depreciating hardware. In the environmental space, Natural Asset Companies value ecosystems for the services they deliver, such as water purification or carbon sequestration. In the energy sector, a transmission network might be valued for the stability it provides to the grid, or a battery system for the resilience it offers during extreme weather. These services, once measured and verified through digital twins, could themselves become monetisable attributes. Service-based valuation is gaining mindshare, pricing stability and resilience services (e.g., frequency regulation or storm-season capacity) rather than just capex. Markets like California’s show batteries delivering far beyond the minimum regulation requirements, signalling that service markets can scale and be monetised independently of energy sales.

How Would It Work?

Figure 2 The Layered Value Stack – how blockchain verification, Energy Reduction Assets, and service-based valuation build into a diversified revenue model for energy infrastructure investors

Consider a coastal wind farm approaching mid-life. With targeted upgrades and predictive maintenance, it runs more efficiently and with fewer outages than its peers. A blockchain-secured digital twin provides continuous proof of these gains. Reduced backup power needs are quantified as avoided energy demand, converted into ERA credits, and sold into a regional market. The farm’s stability during seasonal storms is also monetised as a resilience service, attracting investment from grid operators seeking guaranteed capacity.

For investors, this creates complementary revenue streams. First, verified ERA credits generate sales proceeds, shared with investors via equity or tokenised performance rights. Buyers may include corporates pursuing efficiency targets, utilities under regulatory pressure, or municipalities seeking sustainable capacity without new builds.

Second, service-based contracts allow resilience capacity to be sold like a capacity market product, with fixed payments tied to agreed service levels. Finally, tokenised performance rights can be traded, offering capital gains as demand for high-quality verified assets grows. This blend of operational income, credit sales, and tradable rights can deliver stronger returns than conventional infrastructure, which is often long-term and illiquid.

Why This Changes the Game

Crucially, it changes incentives. Instead of maintaining assets to avoid loss, owners would have reason to enhance performance continuously — not only for environmental or operational reasons but because it pays.

This model shifts value creation from pure output to performance. Asset owners monetise operational excellence; investors gain fractional access to diverse revenue streams; regulators link returns to efficiency and resilience. Incentives change: owners enhance performance continuously, not just to avoid losses but because it pays.

Challenges remain; tokenisation infrastructure is nascent, ERA market rules are incomplete, and poorly designed blockchain can be energy-intensive. Equity concerns also risk favouring large players over smaller owners. These can be addressed through regulatory sandboxes, low-energy blockchain protocols, shared ownership models, and clear governance.

The energy transition will demand more than new technology; it will require new ways of valuing what we already have. Linking ERAs, blockchain-secured digital twins, and NAC-inspired valuation offers a pathway to make performance itself a tradeable commodity. This is not carbon offsetting by another name, it is a direct monetisation of measured efficiency, resilience, and service quality.

Consultants and industry leaders could shape the frameworks that make this possible, bridging technical innovation with market design and regulation. If we succeed, asset management will move from the background of the energy sector to its forefront — not just keeping the lights on but helping fund the very future of the grid. The question is no longer if such a transformation can happen, but who will lead it.

Written by:

Nicolette Cross, Senior Associate

References

CAISO. (2023). 2023 Special Report on Battery Storage. California Independent System Operator. Retrieved from https://www.caiso.com

CAISO. (2024). 2024 Special Report on Battery Storage. California Independent System Operator. Retrieved from https://www.caiso.com

CAISO. (2024). Q3 2024 Market Issues & Performance Report. California Independent System Operator. Retrieved from https://www.caiso.com

Energy Efficiency 2023. (2023). IEA Energy Efficiency 2023 Report. International Energy Agency. Retrieved from https://www.iea.org/reports/energy-efficiency-2023

Grand View Research. (2024). Digital Twin Market Size, Share & Trends Analysis Report. Retrieved from https://www.grandviewresearch.com

Italian National Institute for Environmental Protection and Research (ISPRA). (2023). White Certificates – Energy Efficiency Titles. Retrieved from https://indicatoriambientali.isprambiente.it

MarketsandMarkets. (2024). Digital Twin Market for Energy & Utilities. Retrieved from https://www.marketsandmarkets.com

Murray, J. (2025, January 23). UK wind farms paid to switch off, costing households £810m. Financial Times. Retrieved from https://www.ft.com

Sifat, M. M. H., Choudhury, S. M., Das, S. K., Ahamed, M. H., Muyeen, S. M., Hasan, M. M., Ali, M. F., Tasneem, Z., Islam, M. M., Islam, M. R., Badal, M. F. R., Abhi, S. H., Sarker, S. K., Das, P. (2023). Towards electric digital twin grid: Technology and framework review. Energy and AI, 11, 100213.

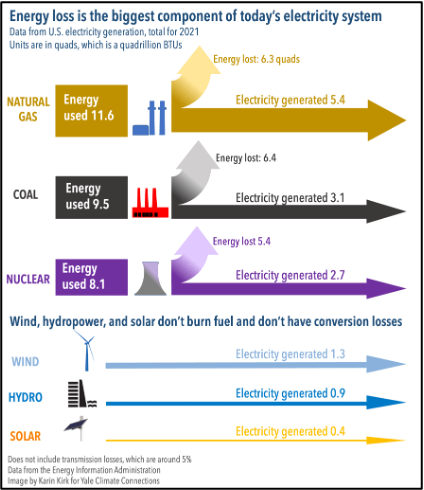

Yale Climate Connections. (2022, October 10). Energy loss is single biggest component of today’s electricity system. Retrieved from https://yaleclimateconnections.org