By Woody Ang & Alaudden Mostafa

The potential remains limitless

Mining and quarrying have been age-old practices in Oman dating back more than 2000 years. The Sultanate is endowed with a variety of mineral deposits such as chromite, gypsum, limestone, building materials and marble. These minerals remain an important asset to Oman’s economy, with the country still possessing approximately 97% unexploited mineral potential from its industrial and metalliferous deposits.

While the mining sector acts as a catalyst for the growth of core industries like steel and cement, its contribution to GDP is still very modest at 0.5% as of 2017. One reason for this is because the sector is led primarily by small-to-medium sized companies, dealing mostly in traditional mining industries such as building aggregates. Given the low-value, high-volume nature of these industrial minerals, there is limited potential for increasing contribution to the overall Omani economy in its current form. The past 5 years have seen production value drop by 3.4%, even though production volumes have grown by 4%. The complex nature of regulating the mining industry has further compounded this scenario. Impediments to investment and growth include the lack of an attractive investment environment and inconsistent enforcement of regulations, particularly in the collection of royalties, and tedious licensing processes. This highly capital-intensive industry also demands a consistently updated geological data at national level, which Oman does not yet possess.

Given the combination of these factors, existing investors and mining operators are limited in number and the country has seen a noticeable reduction in exploration and developmental projects. This impacts the sector’s growth and sustainability prospects and its potential contribution to GDP.

Against this backdrop, Oman recognised that significant steps are required to remove the obstacles to sector growth. To lead the sector’s transformation effort, the Public Authority for Mining adopted a collaborative, result-driven approach for Oman with the introduction of the Mining Lab via PEMANDU Associates’ Big Fast Results Lab Methodology. The lab focused on three key pillars: optimising industrial minerals value contribution, reviving significant value contribution from metalliferous minerals and improving the sector’s business environment and governance.

Investors and Private Sector lead the way

When attempting to identify the real economic potential of these industrial minerals, many conclude that a simple extract-and-sell strategy is sufficient to generate growth. The Lab provided a platform of discourse and rigorous analysis which revealed that this widely held view was untrue. Despite the availability of these natural resources, Oman struggled to deliver a competitively priced product to market. The final cost of industrial minerals such as limestone are highly dependent on the geographical distance and logistical requirements between both the source mines and the destinations seeking the commodity. It was therefore important for Oman to find ways to capitalise on its geographic location to reduce the cost-to-market.

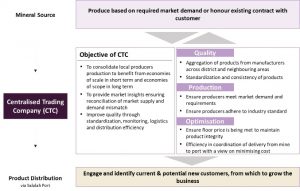

Following careful consideration and selection, the Lab recommended the formation of a Centralised Trading Company (CTC) led by a consortium of private industry players to optimise the handling of outgoing production to better fit market demand. The CTC will look to maximise value extraction by also optimising available logistics and exhibiting strict cost discipline to derive maximum value for the country’s producers.

To complement the CTC, focus will also need to be shifted beyond upstream activities towards higher value downstream manufacturing. The Lab identified and prioritised nine private sector-led integrated downstream industrial minerals projects aimed at delivering tangible results leading up to 2023. Amongst the pathfinder projects include the extraction of basalt to produce continuous basalt fibre, the extraction of dolomite to produce magnesium metal and the extraction of potash to produce premium grade potassium.

Despite metalliferous minerals being the high value contributor amongst the existing commodities, new exploration activities have dwindled over the past decade with almost no new development projects to replace ageing mines. This is particularly evident in the copper sector where there are currently no active mines despite strong proven resources available in the country.

The Lab nevertheless enabled the identification of private sector-led upstream and downstream projects for copper and chromite, along with potential downstream development opportunities in magnesium and silicon. These projects include 14 copper project sites and three new concentrator plants to reinitiate copper production and enable feed to downstream by import substitution of concentrates.

Aside from copper, 28 private investment -led chromite project sites and one beneficiation plant were identified to increase chromite production and optimise utilisation of local chrome resources in Oman, which can be fed to downstream ferrochrome plants.

After six weeks of robust deliberations, the Lab successfully unlocked the Washihi Integrated Copper Mining Project, Oman’s first copper mining project in 14 years. The project marks a resumption of copper mining activity, which truly is an example of Big Fast Results in action.

It’s all about the right Business Environment

With investors ready to commit, it is imperative that the business environment is made as conducive as possible to realise these investments. The existing licensing process requires dealings with eight different government entities whilst there is little transparency on the tax and royalty regime – these will now need to change.

Firstly, it was decided that the licensing process will be simplified via a single entity adhering to a clearly stipulated approval timeline and implementing a pre-approval clearance mechanism. With the introduction of this new process, previously lengthy license processing timelines that could take months and sometimes years will now be a thing of the past. This will also eliminate the prior lack of standard operating procedures that necessitated investors to follow-up with the Public Authority on the status of the requested approvals regularly on their own.

Secondly, the Lab also recommended a dynamic royalty rate to replace the previous flat royalty rate of 10% across commodities; a rate which is relatively higher than in other mining countries. The proposed dynamic royalty initiative will apply commodity-based formulas where different minerals will be subjected to different valuation methods or rates. In addition to this, the Lab also proposed a royalty discount mechanism upon fulfilment of certain set criteria which include downstream production promotions, amongst others. Such incentives should ensure higher in-country value and will incentivise industry growth.

Exciting times now lie ahead for Oman’s Mining sector and there is great optimism on the newly-formed winning coalition between the public and private sector. Oman has taken bold decisions and significant steps towards improving the outlook for the sector. In total, the Labs unlocked more than 10 new exploration licenses and documented another 50 applications to be further reviewed for potential approval. This injection of urgency is a far cry from the original state of having minimal to no new exploration projects.

With committed private investments amounting to more than OMR50 million for shovel-ready projects, the Public Authority of Mining is committed and fully aware of the need to lead the way in breaking down the silo mentality that often permeates within Government. All that remains is for the key industry and Government stakeholders to maintain the discipline of action and stay the course that they have plotted together. The mining engine of Oman has gotten a much-needed restart and the country hopes it will begin to truly fulfill its untapped potential.