By Tengku Nurul Azian Tengku Shahriman, Executive Vice President & Partner

It is a sign of growth when countries start talking about raising the minimum wage. It demonstrates confidence in the resilience of the economy, and the need to prioritise the wellbeing of low-earning workers in the country. Malaysia had increased its minimum wage to RM1,200 earlier this year as part of a policy to address the country’s growing urban poverty and combat income inequality. However, it was met with outcry from some quarters who pointed out the lack of due warning and absence of a clear implementation programme for companies to adequately prepare themselves ahead of the wage hike. Others raised the issue that a RM100 increase was still not enough to cover basic expenses.

Malaysia is now under a different government, with a new Prime Minister at its helm. There is an opportunity here for the new administration to pick up where the former left off and turn the minimum wage increase into a positive and actionable policy. But first, it is important to understand the argument around minimum wage in its entirety, from its impact on the economy to how businesses can cope with the increase.

1. Why raise the minimum wage at all?

Setting a minimum wage protects workers against unduly low pay. It allows the government to set the terms of employment and working conditions.[1] With the right policies in place, the minimum wage can be a tool for the government to overcome poverty and reduce income inequality.

Malaysia first set a minimum wage in 2013. This was done as part of a larger programme aimed at ensuring inclusivity and boosting the economy to high-income status. It was calculated based on a variety of factors: the poverty line, productivity growth, consumer price index, unemployment rate (actual, region), average wage per household and medium wage. At the time, the wage was estimated to benefit about 27% of workers nationwide.

By right, the minimum wage should reflect increases in the cost of living to ensure that workers can afford to buy basic necessities. However, the minimum wage has only been increased a couple of times since its introduction in 2013 – first in 2016 when it was raised to RM1,000 a month, to RM1,050 a month, and then to RM1,100 a month in 2019. This year would be the fourth time.

This mismatch between the minimum wage and rising cost of living has had the biggest impact on low-income households. Since 2014, the monthly income of the bottom 40% (B40) has grown by 5.8% annually – but after accounting for the increase in the cost of living, the growth is actually at around 3.8%.[2] At the same time, household expenditure grew at a faster pace of 6%, leaving these households with very little money to spend.[3]

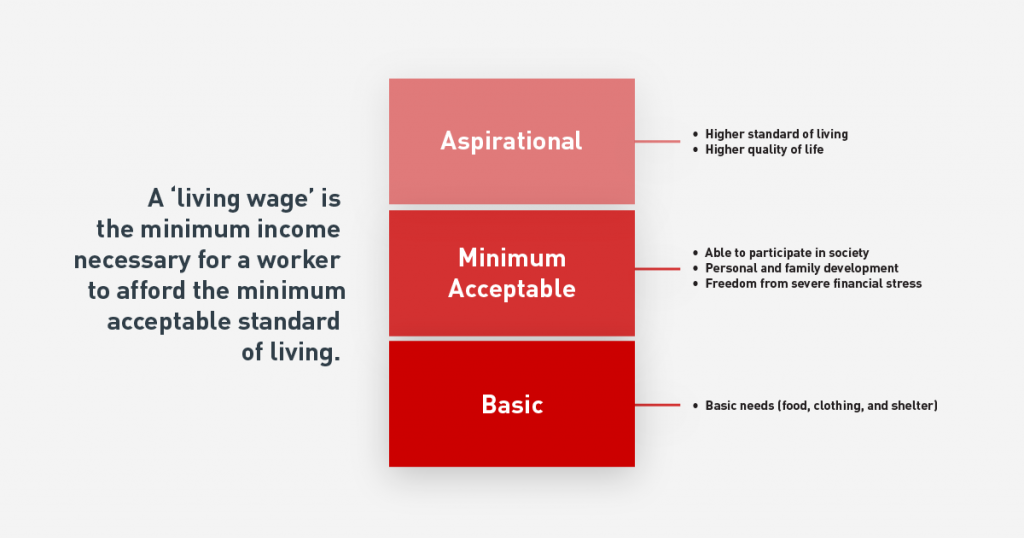

In 2018, Bank Negara Malaysia (BNM) introduced the concept of a ‘living wage’[4]. Defined as a wage level that could afford the minimum acceptable living standard, a living wage would allow individuals to sustain a decent standard of living beyond just the basic necessities such as food, clothing and shelter. It should also provide for personal and family development, social participation – such as occasionally being able to purchase gifts for family members – and financial security.

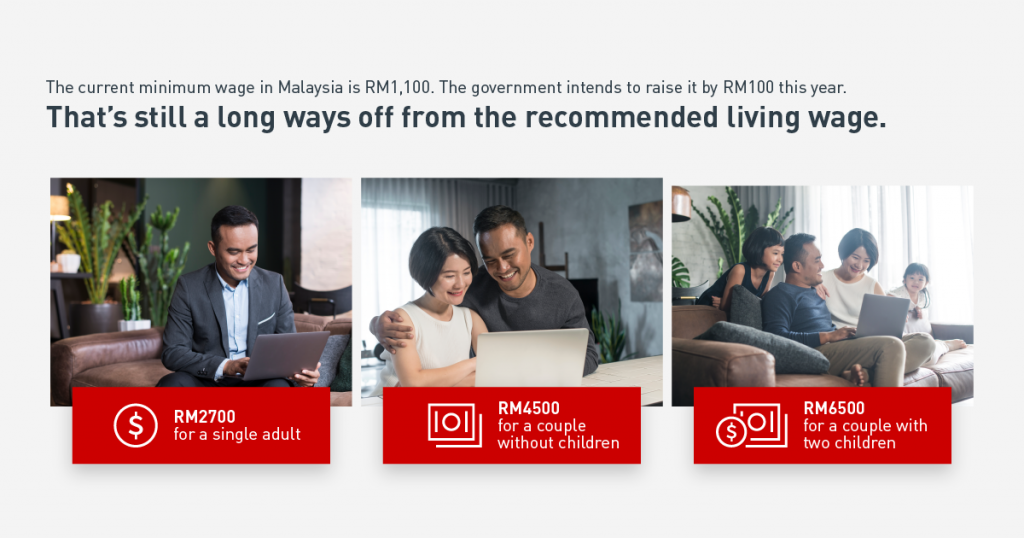

The report calculated the estimated living wage for Kuala Lumpur as follows:

- A single adult, renting a room and frequently using public transport, would require RM2,700 a month to maintain the minimum acceptable living standard in the city

- A couple with no children renting a one-bedroom apartment would require RM4,500 a month

- Families with two children would require RM6,500

Even with the RM100 increase, the current minimum wage of RM1,200 is still much lower than Bank Negara’s projected living wage.

To compare, the monthly income in 2016 for B40 households living in Kuala Lumpur was reported by the Statistics Department as RM5,344[5] – lower than the estimated living wage of RM6,500. This has made it challenging for such families to afford basic necessities, much less a home, car or other consumer goods, causing many to look for supplementary sources of income. More people are resorting to working two jobs or deriving income from a side business just to make ends meet, contributing to the rise of Malaysia’s gig economy.[6]

Increasing the minimum wage can provide these communities with a safety-net, allowing them to afford more than just the absolute basic necessities. It is also important to ensure that the minimum wage stays relevant. This can be done by holding an annual review, checking the set wage against current cost of living and overall health of the economy, and make the appropriate adjustments.

2. How will the increase impact the economy?

The biggest risk raised is that the wage increase would be set too far above the rate that employers can afford to pay their employees, forcing them to lay off workers if they can’t offset that cost in some other way.

However, research suggests otherwise. Studies have found that increasing the minimum wage is often beneficial. The University of Washington has been studying the impact of raising the minimum wage in Seattle on its economy; a recent report shows that low-income workers were better off as a whole after the increase.[7]

This is no different for developing countries. North Macedonia underwent a bold reform of its minimum wage system in 2017, increasing the minimum by 19% and introduced the same wage in all sectors. The International Labour Organisation (ILO) found that it was successful in reducing wage inequality without negative impact; after the reform, only 4.3% of wage earners were in the low wage category (compared to 14.7% before the reform), and the bottom 10% received a share of 4.6% of all wages in the country which is well above the European Union’s average of 3.6%.[8]

One of the challenges ahead for the new government will be to revive the national economy. Malaysia is currently facing various threats, from the Covid-19 outbreak to international trade wars, and is coming off the back of a slow fourth quarter growth. This is compounded by the recent political uncertainty which has caused the Malaysian stock market to plummet. One way to spur the economy is by increasing purchasing power of the rakyat; this can be done by increasing wages and thus providing them with a little more disposable income. It could also boost overall purchasing power and contribute to household consumption. [9] Higher basic wages to the low wage earners could boost the income of small- and micro-businesses in Malaysia. Even modest rises in the national minimum wage could make a big difference to disposable income.

3. What does this mean for businesses?

A gradual increase in minimum wage provides the opportunity for business leaders to review their operations and make the necessary adjustments or optimisation to balance the higher cost of employment. It may even stimulate a larger transformation in the organisation’s strategy or operations that will make their business stronger in the long run.

For businesses that might be impacted by the raise, preparation is key. Here are some ways they can ready themselves:

- Figure out how much the increase is going to cost – Are there business expenses that can be reduced? Is the budget flexible enough to accommodate redistribution of funds? A segmented P&L exercise can help companies determine at a very granular level which areas are making a loss, and which are turning a profit. This will enable companies to see if they can accommodate a minimum wage increase.

- Look for ways to increase productivity – Is the business being as efficient as possible? Are there areas that can be improved? Setting a strategic direction and ruthlessly prioritising the most productive and efficient initiatives will help to ensure greater focus overall and maximise the trend and speed of delivery. Set key performance indicators and monitor them religiously to ensure that progress is being done.

- Leverage on technology –What manual activities in the day-to-day operations can be automated? Are there any processes that can be upgraded by using new technological innovations? The idea here is to use technology not just to replicate an existing service in digital form but to transform that service into something significantly better.

A minimum wage increase isn’t a death sentence for businesses. Rather, it can be an opportunity for companies to transform their organisation into one that is agile, productive and digitally-forward.

4. How can the government manage the shock to the economy?

When the RM1,200 minimum wage was first announced late last year, businesses were taken by surprise by the increase and resistant to any change to the minimum wage. Representing one of the major industries in Malaysia, the Federation of Malaysian Manufacturers has stated that the industry is not against the increase in the minimum wage, but there should be a “clear and certain roadmap for the phases of increase, including the areas of coverage, to provide clarity and certainty to the business community for their respective budgeting and planning purposes”[10].

As with any socio-economic policy, it is important that both the public and the private sectors are aware ahead of time about what is being planned and how it would be rolled out, as well as any support that would be available to ease its implementation. This could be done by publishing a public roadmap, followed by an annual review of its implementation and effectiveness.

To raise or not to raise?

Over 20% of Malaysian households earn below the relative poverty line.[11] Increasing the minimum wage – perhaps even to over RM1,200 – is a good idea and one that has the potential to help a lot of B40 communities. However, any increases to the minimum wage should be done gradually and openly.

Much of the resistance to raising the minimum wage was due to the suddenness and perceived lack of planning on a key socio-economic issue as opposed to the increase itself. A clear implementation plan, with a condition to review the set minimum wage each year to ensure its relevance given the current economic landscape, would help to clarify the issue and let the public know what to expect.

This is an opportunity for the new administration to take the lead on a popular issue and work together with both businesses and unions to deliver a truly transformative policy.

[1] International Labour Organisation (ILO), 2020

[2] ‘The Living Wage: beyond making ends meet’, Bank Negara Malaysia, 2018

[3] New Straits Times, 2018

[4] ‘The Living Wage: beyond making ends meet’, Bank Negara Malaysia, 2018

[5] The Star, 2019.

[6] Ibid.

[7] Evans School of Public Policy & Governance, 2020

[8] ILO, 2019

[9] The Edge Markets, 2019

[10] The Edge Markets, 2020

[11] The Star, 2019