With 95.7% of its population gaining access to the internet [1], Malaysia is connected, however is it competitive? Coverage has expanded, and data costs have fallen. Yet queues at public clinics remain, ports still face delays, and many SMEs struggle to scale. The challenge for Malaysia is no longer connectivity itself, but conversion, turning networks into productivity, jobs, and real growth.

To become a high-income, digitally enabled nation and regional leader in the digital economy, Malaysia must look beyond treating telecommunications as a utility and start treating it as a national competitiveness driver[2].

The Infrastructure Multiplier: Beyond Connectivity

Nations compete for economic leadership, and strategic telecommunications infrastructure has become one of the most powerful levers for transformation. Unlike traditional infrastructure that serves specific sectors, modern telco infrastructure is sector-agnostic, a force multiplier for healthcare, education, agriculture, manufacturing, services, and more.

Modern telecommunications infrastructure functions as an “enabling technology,” a foundational capability that unlocks productivity gains across multiple sectors simultaneously. Every ringgit invested in strategic telco infrastructure generates compounding economic benefits that ripple across the economy.

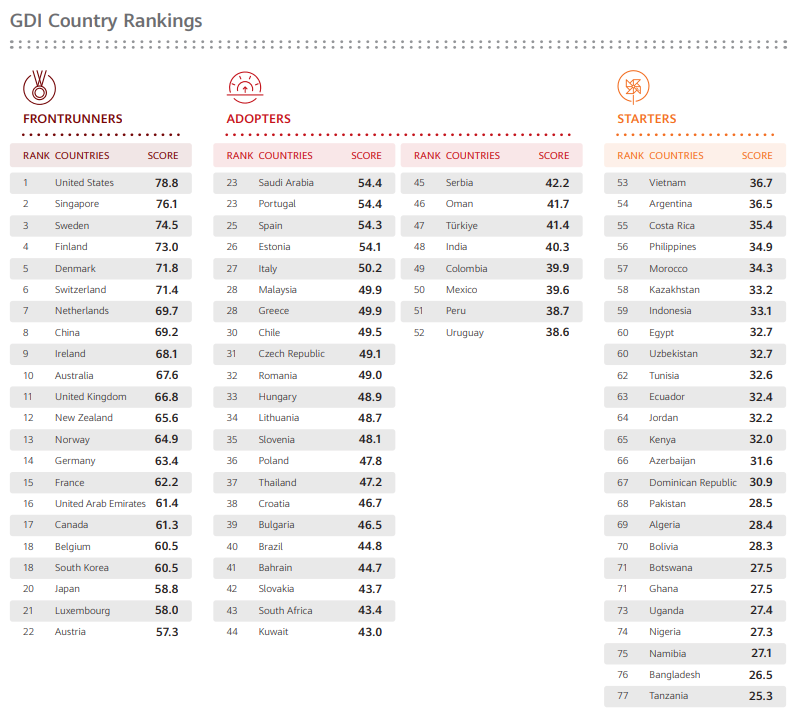

Global studies highlight the scale of this effect. The World Bank found that a 10% increase in fixed broadband penetration correlates with 1.38% GDP growth in developing economies and 1.21% in developed economies [3]. Huawei’s 2024 Global Digitalisation Index (GDI) shows that in frontrunner countries, each one-point GDI gain creates 5.4 times more economic value than in starters. They also found that every US$1 invested in digital transformation returns US$8.3 to the digital economy[4].

For Malaysia, the takeaway is clear. When nations pair robust digital foundations with ubiquitous connectivity, they reinforce each other. That is the true multiplier, and it is how we bridge divides and drive inclusive growth.

Where Malaysia stands in Digital Competitiveness

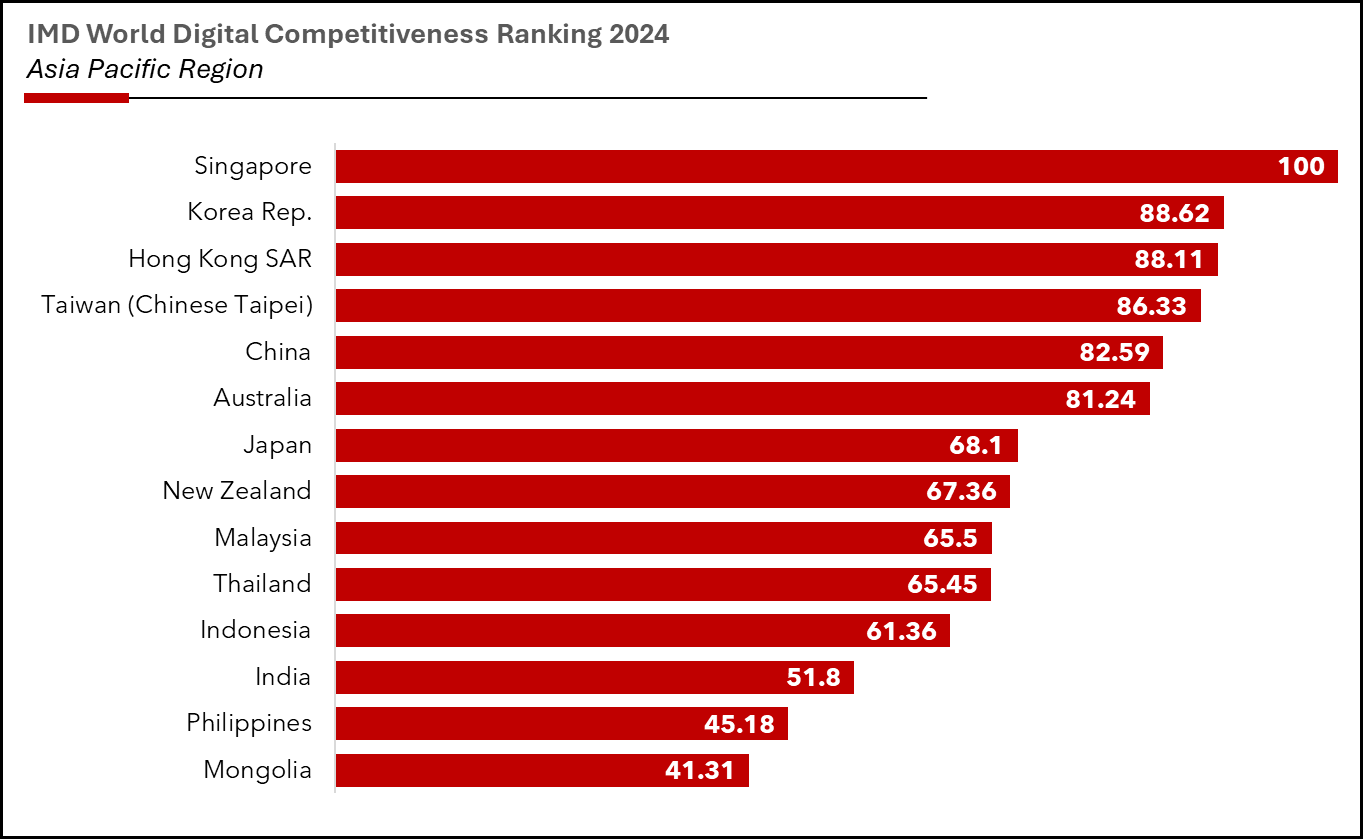

The IMD World Digital Competitiveness Ranking [5] measures the capacity and readiness of economies to adopt and explore digital technologies for economic and social transformation evaluated across three main factors, namely, knowledge, technology, and future readiness.

In 2024, Singapore ranked #1 globally, climbing two spots from previous year. Malaysia, by contrast, ranked ninth (9th) in Asia-Pacific, positioning us as a mid-tier player in one of the world’s most digitally dynamic regions.

Huawei’s GDI [5a] puts Malaysia in the “Adopter” tier, with a score of 49.9 trailing “Frontrunners” like the US and Singapore. This shows that while we have built decent foundations, we have not yet translated connectivity into competitiveness.

Malaysia has built strong digital foundations but has yet to fully translate connectivity into competitive advantage. Targeted infrastructure investments can turn Malaysia from an adopter into a frontrunner.

Regional Benchmarks: Strategic Infrastructure as Development Catalyst

1) Singapore’s Smart Nation Integration Model

Singapore’s approach to telecommunications infrastructure demonstrates how strategic coordination can maximize economic impact despite geographic constraints. Singapore’s integrated strategy has generated:

- A digital economy contributing 17.3% of GDP, significantly above regional averages [6]

- Ranked third (3rd) in the world as part of United Nations e-Government Survey on government digital services across 193 member states [7]

- A leading fintech in the region with over 1,300 FinTech firms and over US$4.1B in FinTech investment in 2022 [8], enabled by robust digital infrastructure and proactive support from Monetary Authority of Singapore [9]

Singapore’s success stems from treating telecommunications infrastructure as an integrated economic development platform rather than a standalone utility, creating synergies between government digitalisation, business innovation, and citizen services.

2) South Korea’s Next Generation Infrastructure Leadership [10]

South Korea’s strategic telecommunications infrastructure investments during the 1990s and 2000s did not just create a telecommunications sector, it enabled the emergence of global technology champions like Samsung Electronics, LG, and Hyundai’s digital transformation. As the world’s first country to launch nationwide 5G services, South Korea’s approach demonstrates the multiplier effects of investing in next-generation telecommunications infrastructure as it provides a compelling case study to leapfrog industry development:

- Government investment commitment of more than KRW30 trillion (approximately RM91.1 billion) through public-private collaboration to build its 5G ecosystem[11]

- Projected domestic economic impact of US$30.3 billion by 2025 and economy is predicted to grow to at least USD 47.8 billion by 2030 [12]

- Healthcare innovation with 5G-powered telemedicine such as machine learning capabilities for operation data analysis, and ICT-based chronic disease management service [13]

- Smart factory solutions such as 5G-AI machine vision for product defect detection [14]

South Korea’s 5G-first approach bypassed incremental 4G investments, instead building infrastructure capable of supporting applications that were not possible with previous generation technologies. This strategic choice positioned South Korea as a global testbed for 5G applications while attracting international technology companies and research investments.

3) Hong Kong’s Data Infrastructure Hub Model: Leveraging Strategic Position

Hong Kong’s telecommunications infrastructure strategy demonstrates how geographic positioning and sector-specific focus can create outsized economic impact despite limited physical space. Hong Kong’s approach provides particularly relevant lessons for Malaysia given similar roles as regional business hubs. Hong Kong has developed into one of Asia-Pacific’s most strategic data-centre hubs driven by its dense submarine cable networks[15] and one of Asia-Pacific’s most established data centre hubs with total data centre capacity per capita of USD 81.6 billion, second only to Singapore’s USD 166.8 billion [16]. Hong Kong’s strategic investments generated measurable benefits:

- Hong Kong’s SuperTerminal 1, Hactl and HKT deployed a 5G private network enabling Autonomous Electric Tractors to operate with real-time coordination, dynamically adapting to traffic and safety conditions while minimizing human intervention and boosting automation. [17]

- Hutchison Port Holdings Trust implemented 5G-linked systems controlling remote rubber-tyred gantry cranes (RTGCs) and AI-enhanced CCTV with intrusion detection, enabling greater automation, reduced costs, and improved accuracy and safety. [18]

- 75% of financial institutions in the city have already implemented at least one generative AI (GenAI) use case or are actively piloting one with projected adoption to reach 87% within the next 3–5 years, signalling robust momentum in leveraging AI across banking operations.[19]

Hong Kong’s approach offers clear lessons for Malaysia. By maximising its geographic advantage to become a regional gateway, aligning telecommunications infrastructure with its core strengths in finance and trade, and building cross-border capabilities to facilitate regional business operations, Hong Kong has positioned itself as a digital hub. These strategic principles, location leverage, sector-specific alignment, and seamless regional facilitation provide valuable insights for Malaysia as it seeks to harness its own diverse economy for digital competitiveness.

From Advantage to Action

Regional examples show that nations that win in digital competitiveness do not just expand coverage, they convert infrastructure into productivity and new industries. Malaysia is no different. Like Singapore, South Korea, and Hong Kong, we hold clear advantages – a central location in ASEAN’s trade routes, a diverse economy spanning agriculture, manufacturing, and services, and a skilled workforce ready to adopt modern technologies. Add to this a proven record of executing national programmes, and the foundations are already strong.

But advantages alone do not create competitiveness. The real test is whether Malaysia can align its many stakeholders, ministries, regulators, telecommunications providers, enterprises, SMEs, and citizens behind a single True North to turn connectivity into higher productivity, better services, and higher-value jobs which contributes to the nation’s economy. Too often, infrastructure is deployed without clear links to sectoral outcomes, or initiatives move in silos without shared ownership.

This is where discipline matters. PEMANDU’s transformation approach, honed through its 8-step BFR methodology, helps solve this problem by providing a way to convene diverse actors, co-design solutions, and lock in measurable outcomes. The power of this discipline is not in rigid process, but in ensuring that multiple efforts add up to one ambition and that progress is tracked, validated, and adjusted when needed.

Each stakeholder has a pivotal role. Government must act as the enabler, integrating infrastructure deployment with economic policy, streamlining permits, and embedding cross-sector coordination. Telecommunications providers must shift from selling bandwidth to offering solutions tied to sector needs. Large enterprises and anchor institutions like ports, hospitals, and universities must pilot and adopt new workflows to show what is possible, and SMEs and citizens must be empowered as adopters through affordable, plug-and-play bundles that combine connectivity, applications, and support.

When these efforts are aligned and measured, Malaysia can convert its latent advantages into tangible outcomes such as healthcare systems that reduce waiting times, education networks that broaden access, IoT-enabled farming that boosts yields, and 5G-ready industrial parks that anchor Industry 4.0. The discipline of the BFR approach ensures these ambitions do not drift into policy statements without impact but are delivered with accountability and transparency.

Conclusion

The region shows that those who treat telecommunications as a driver of competitiveness surge ahead. Malaysia must ensure investments are guided by transparency and measured by the outcomes. As Prime Minister Anwar Ibrahim cautioned, we must avoid the “trough of disillusionment” [20], where large allocations fail to deliver real change. Malaysia must now focus on outcomes, not just inputs. Acting with urgency and discipline will decide if Malaysia moves from coverage to competitiveness, or risks being overtaken by its peers.

Written by:

Atiqah Shazlin: Senior Manager

References:

[1] Ministry of Economy Department of Statistics Malaysia. (2025). ICT Use and Access by Individuals and Households Survey Report, 2024. Retrieved from https://www.dosm.gov.my/site/downloadrelease?id=ict-use-and-access-by-individuals-and-households-survey-report-2024&lang=English&admin_view=

[2] Ministry of Economy. (2021). Malaysia Digital Economy Blueprint. Retrieved from https://ekonomi.gov.my/sites/default/files/2021-02/malaysia-digital-economy-blueprint.pdf

[3] Michael Minges. (2015). Exploring the Relationship Between Broadband and Economic Growth. Retrieved from https://documents1.worldbank.org/curated/en/178701467988875888/pdf/102955-WP-Box394845B-PUBLIC-WDR16-BP-Exploring-the-Relationship-between-Broadband-and-Economic-Growth-Minges.pdf

[4] Huawei. (2024). Global Digitalization Index 2024. Retrieved from https://www-file.huawei.com/-/media/corp2020/gdi/pdf/gdi-2024-en.pdf?la=en

[5] IMD World Digital Competitiveness Ranking 2024 World Competitiveness Center. (2024). The digital divide: risks and opportunities. Retrieved from https://imd.widen.net/s/xvhldkrrkw/20241111-wcc-digital-report-2024-wip

[6] Infocomm Media Development Authority & Lee Kuan Yew School of Public Policy, National University of Singapore. (2023). Singapore Digital Economy Report 2023. Retrieved from https://www.imda.gov.sg/-/media/imda/files/infocomm-media-landscape/research-and-statistics/sgde-report/singapore-digital-economy-report-2023.pdf

[7] GovTech Singapore. (2025). Our digital government rankings. Retrieved from https://www.tech.gov.sg/about-us/our-achievements/our-digital-government-rankings

[8] Monetary Authority of Singapore. (2024). FinTech and Innovation. Retrieved from https://www.mas.gov.sg/development/fintech

[9] FIDE Forum. (2023). Event Report Observations from FIDE FORUM. Retrieved from https://fideforum.org/FideForum/media/documents/Singapore-Fintech-Festival-2023-Report-by-FIDE-FORUM.pdf

[10] OECD. (2021). Korean Focus Areas: A global powerhouse in science and technology. Retrieved from https://www.oecd.org/en/publications/korean-focus-areas_f91f3b75-en/a-global-powerhouse-in-science-and-technology_61cbd1ad-en.html#:~:text=Korea’s%20rapid%20digital%20transformation,high%2Dquality%20connectivity%20becomes%20essential.

[11] Ministry of Science and ICT. (n.d.). Science, Technology & ICT Newsletter( NO.41 ). Retrieved from https://www.msit.go.kr/eng/newsLetter/view.do?sCode=&mId=&mPid=&pageIndex=3&newsLetterSeqNo=41&searchOpt=#:~:text=Also%2C%20the%20Korean%20government%20announced,nationwide%205G%20network%20by%202022.

[12] Eastspring Investments. (2020). 5G & South Korea: Beyond the hype. Retrieved from https://www.eastspring.com/hk/insights/5g-south-korea-beyond-the-hype

[13] STL Partners. (n.d.). Digital health in South Korea: five examples of digital health beyond telemedicine. Retrieved from https://stlpartners.com/articles/digital-health/digital-health-in-south-korea-five-examples-of-digital-health-beyond-telemedicine/

[14] World Bank Group Korea Office. (2021). Entering the 5G Era: Lessons from Korea. Retrieved from https://documents1.worldbank.org/curated/en/852791623927787358/pdf/Entering-the-5G-Era-Lessons-from-Korea.pdf

[15] Submarine Cable Networks. (2025). Hong Kong. Retrieved from https://www.submarinenetworks.com/en/stations/asia/hongkong

[16] KPMG. (2025). The Asia Data Centre Landscape. Retrieved from https://assets.kpmg.com/content/dam/kpmg/cn/pdf/en/2025/03/the-asia-data-centre-landscape.pdf

[17] TELECOM Review. (2025). HKT, Hactl Unveil Hong Kong’s First 5G-Enabled Air Cargo Terminal. Retrieved from https://www.telecomreviewasia.com/news/network-news/13090-hkt-hactl-unveil-hong-kongs-first-5g-enabled-air-cargo-terminal/#:~:text=Autonomous%20Electric%20Tractor%20(AET)%20Operations,leader%20in%20smart%20cargo%20operations.%E2%80%9D

[18] Ionna, K. (2023). HPH Trust implements 5G technology at its Hong Kong container terminals. Container News. Retrieved from https://container-news.com/hph-trust-implements-5g-technology-at-its-hong-kong-container-terminals/

[19] The Government of the Hong Kong Special Administrative Region. (2025). Report on “Financial Services in the Era of Generative AI: Facilitating Responsible Adoption”. Retrieved from https://www.info.gov.hk/gia/general/202504/09/P2025040900279.htm

[20] Bernama. (2025). Anwar cautions against ‘AI Productivity Paradox’ in digital transformation. The Edge Malaysia. Retrieved from https://theedgemalaysia.com/node/766915