Malaysia’s Budget 2019 scheduled announcement on 2 November 2018 is widely anticipated, as it will be the country’s first budget to be tabled by the new government.

Much has been and will be debated on the contents of the budget, as the Pakatan Harapan government has made it clear that its priority is on improving its fiscal position. Its mid-term review of the 11th Malaysia Plan on 18 October 2018 already provided some hints on the government’s fiscal direction, with expectations high for spending cuts and the introduction of new taxes to optimise public finances.

With a period of belt-tightening seemingly on the cards, Transformation Today talked to Malaysian individuals and small business owners* who make up the pulse of the country’s economy, to reveal their wish list for the budget and direction they hope will be set for Malaysia Baharu.

The issue of taxation appeared foremost on the mind of every day Malaysians, with the recent return to the Sales and Services Tax (SST) from the Goods and Services Tax (GST) creating a divided opinion from consumers. While the GST shouldered much of public blame for the cost of living in recent years, the rakyat seems to have found its abolishment has not had the desired impact.

Anne, who works in the legal department of an oil and gas firm and is a mother of twin 9-year old boys, says she did not observe a reduction in prices during the interim ‘tax holiday’ which saw the GST zero rated prior to the re-introduction of the SST.

“The rule of thumb is that once prices in Malaysia go up, they will almost never go back down,” she opines, sharing that both types of taxes made her more prudent with her family’s expenditure. She adds that while she understands austerity measures may be necessary to reduce the country’s debt level, it should instead take the form of prudent government spending as opposed to increasing the tax burden for Malaysians.

The higher consumer prices were also felt by Adib and Imran, both young executives in the private sector who believe businesses are profiteering from the reversion to SST. To this, Imran advises the public to galvanise their mandate by reporting such cases to the Ministry of Domestic Trade and Consumer Affairs.

It is in fact the government’s mandate that Malaysians are eager to remind the ruling administration of as it unveils its maiden annual budget. “I feel that the goverment should refocus its expenditure on the essentials, namely healthcare, education, agriculture and economic infrastructure. For the time being, the government should refrain from undertaking duplicative and non-essential initiatives.

It is in fact the government’s mandate that Malaysians are eager to remind the ruling administration of as it unveils its maiden annual budget. “I feel that the goverment should refocus its expenditure on the essentials, namely healthcare, education, agriculture and economic infrastructure. For the time being, the government should refrain from undertaking duplicative and non-essential initiatives.

“The primary focus of the government should be to reinvigorate the Malaysian economy, make it a business-friendly climate and encourage foreign direct investments. But more importantly, the government needs to open up new economic sectors and stimulate the creation of new jobs from these new sectors. A new Malaysia should mean a new economy and new jobs,” says Anne.

Luqman, a sales administrator and developer who works for a Malaysian telecommunications company in the US is also concerned on the impact of the economic environment on the job market. As a fresh graduate, he worries that more taxes will affect corporate spending, which may in turn influence their hiring decisions. However, he is cognisant that this may be a short-term pain aimed at improving the country’s prospects in the long-run. “My generation has to figure out a way that is less dependent on government incentives,” he opines.

Luqman’s long-term view provides a peek into the vibrant patriotism witnessed in Malaysia since the 14th General Elections in May this year. The public has voiced their support for the government to trim its debt level, to the extent of creating the publicly-funded ‘Tabung Harapan’, which will cease collections on 31 December 2018, to contribute to the repayment of government debt.

However, the public appears to have adopted a ‘wait and see’ approach on the government’s performance before committing to further support. Imran notes that while he sees himself as patriotic, he is not prepared to contribute more than required to government coffers until the government reveals more details on its plans for economic development.

Nonetheless, despite the caution on spending displayed by the government thus far, the public remains hopeful that Budget 2019 will still provide some cheer. For Aida, a home baker based in Putrajaya, tax cuts on essential grocery and bakery items are on her budget wish list, as well as more incentives, grants and easier access to financing for small/micro businesses, targeted at youth in particular.

Another small business owner, Fong, who operates an independent bookshop in Petaling Jaya, points out that the government should recognise other priority areas in commerce beyond typical sectors such as property development and investment, such as bookselling, which play a vital role in community development. He also suggests the budget include incentives for booksellers, especially in line with UNESCO’s recent naming of Kuala Lumpur as the World Book Capital for 2020.

As the budget announcement looms, the government can seemingly be assured of the public’s awareness and understanding of the need to reform public finance and stimulate the economy. However, Malaysians have made it clear that above all, they will favour a wise and prudent government to steer the country on its new path.

*Full names have been withheld at the individuals’ request for privacy

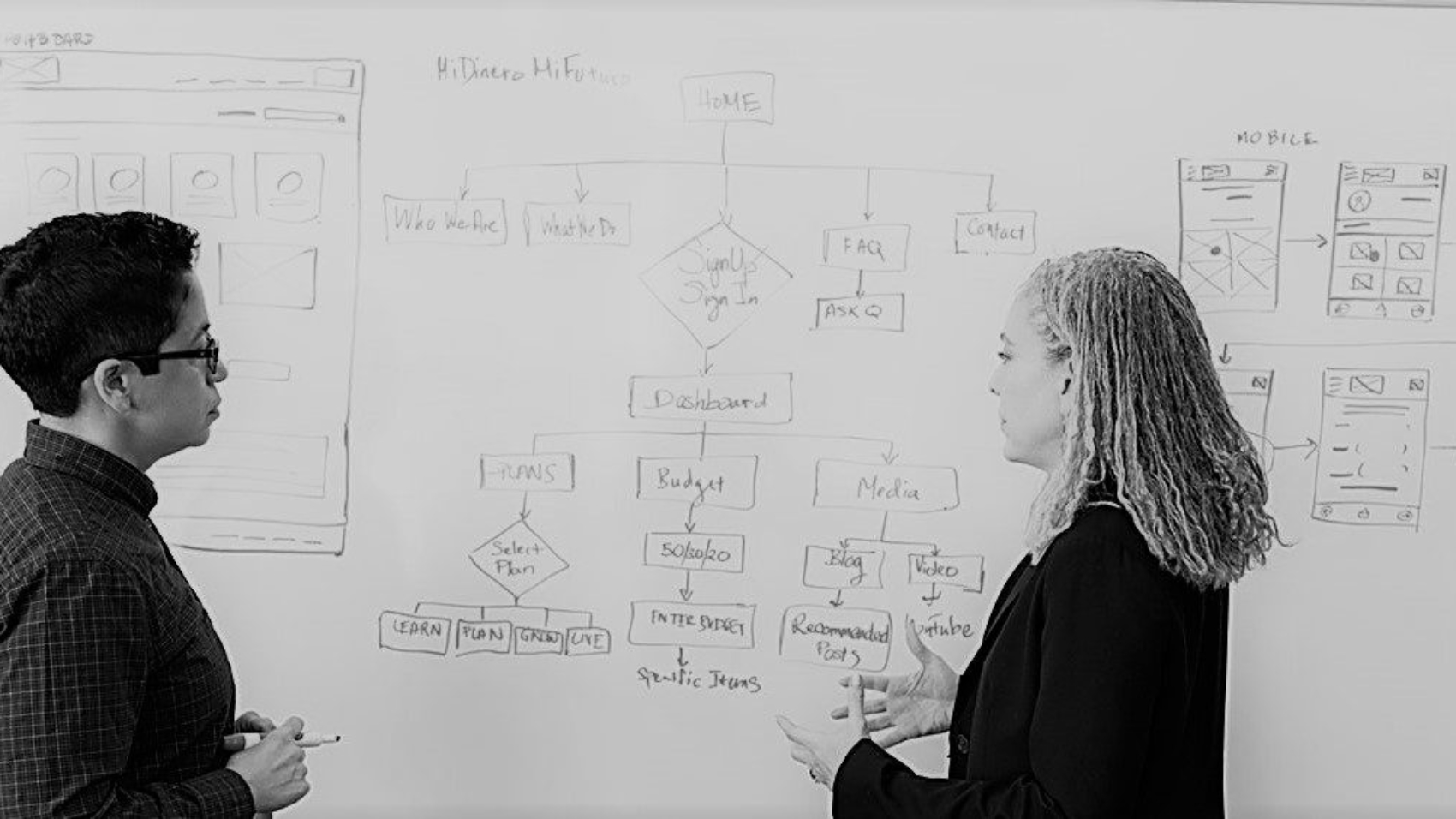

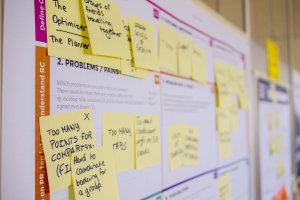

Mindlab was initially intended to operate for a few years, but it succeeded in remaining relevant by focusing on current issues and always planning ahead of trends. Its reach across the government is unprecedented and has resulted in a major shift in how organisations think and work in Denmark.

Mindlab was initially intended to operate for a few years, but it succeeded in remaining relevant by focusing on current issues and always planning ahead of trends. Its reach across the government is unprecedented and has resulted in a major shift in how organisations think and work in Denmark. The adoption of the lab methodology globally has shown how labs help governments deep dive into specific subject areas and get their implementation programme right at the start to ensure the success of their transformation agenda. However, whilst the labs are an innovative tool and environment to chart out a true north for any transformation agenda, it is only an initial step of a transformation.

The adoption of the lab methodology globally has shown how labs help governments deep dive into specific subject areas and get their implementation programme right at the start to ensure the success of their transformation agenda. However, whilst the labs are an innovative tool and environment to chart out a true north for any transformation agenda, it is only an initial step of a transformation.