By Yong Yoon Kit and Khairunnisa Ghazali

Business tourism is defined by the International Congress and Convention Association (ICCA) as “the provision of facilities and services to the millions of delegates who annually attend meetings, congresses, exhibitions, business events, incentive travel and corporate hospitality”.

It is an expansion of the traditional Meetings, Incentives, Conferences and Exhibitions (MICE) sector by interconnecting with activities within the tourism sector of the host country. Attracting business tourists to attend events at a host country is crucial as over 25% of international delegates are likely to bring their spouses along with approximately 65% of these delegates returning with family and friends in the future (Economic Transformation Programme [ETP] Lab Report, 2010).

Business tourism itself had a larger multiplier effect to the economy. Furthermore, it was less affected by seasonal price fluctuations and was typically used to reduce the ‘peak-trough’ differences in the year.

However, Malaysia was trailing behind Singapore, Indonesia and Thailand in the business tourism sector as events in Malaysia were mainly fuelled by small to mid-sized local and regional conference events. This presented a strong case for Malaysia to develop and be positioned as a leading business tourism destination to attract high-quality international events with large numbers of delegates. This, in turn, was targeted at translating into higher receipts quantitatively as well as generate qualitative benefits in terms of enhanced trade and know-how. It was estimated that for every RM1 spent by the government of Malaysia, there was a return-on-investment of RM111 in revenue obtained by the business tourism industry (ETP Lab Report, 2010).

The Malaysian Convention & Exhibition Bureau (MyCEB) that was set up in 2009 was specifically formed to drive the growth of the business tourism ecosystem in Malaysia. To help formalise its operations and funding from 2010 onwards, business tourism became one of the Entry Point Projects (EPP) under the Tourism National Key Economic Area (NKEA), one of the sectors identified under the National Transformation Programme. The Tourism NKEA had an ambitious goal of growing the business tourism sector to reach an 8% share of total tourist and international delegate arrivals by 2020 from a baseline of 5% in 2009.

Detailed Action Steps and Solutions Undertaken

Three main approaches were taken by the government to develop the sector:

Strengthening core operations to drive the industry

Provision of adequate funding to develop the sector

The Performance Management and Delivery Unit (PEMANDU, now a private entity known as PEMANDU Associates), then part of the Prime Minister’s Department of Malaysia, played a pivotal role in securing adequate funding from the government for MyCEB’s operations and development of the industry. The subvention funds issued by MyCEB to the private sector were allocated via a stringent mechanism and careful monitoring to ensure these funds were utilised to support achievement of the number of tourist arrivals and yield.

Implementation of a robust monitoring mechanism

This EPP’s progress was tracked via a stringent monitoring mechanism put in place by PEMANDU. Robust Key Performance Indicators (KPI) were crafted to drive achievement of the desired outcomes for this project. The indicators measured were primarily focused on the number of international delegates secured for each event and the estimated economic impact from the events hosted. The progress in achieving the KPIs were reported monthly while implementation issues were reviewed and resolved on a weekly basis.

Change of event management to maximise tourist yield

Taking a step further from event organisation, additional activities were conducted by MyCEB to tie the business events with other tourism activities. Cross-selling opportunities were taken where each event was provided pre and post-event tour options and delegates were clearly informed of the tourist activities available in order to maximise yield.

Coordination of players

Leveraging on industry experts

Getting the private sector to take ownership in developing the industry together was crucial. Thus, the Malaysia Conference Ambassador ‘Kesatria’ Programme made up of key opinion leaders and industry experts was launched in 2012. The programme’s objective was to encourage potential local hosts to bid for and stage international conventions. 47 ‘Kesatria’ ambassadors have been appointed, generating 135 leads with the potential to bring in 200,000 delegates and an estimated economic impact of RM2.1 billion.

Improving government’s facilitation of the industry

In addition to the focused attention by MyCEB, the government played a strong role in facilitating the growth of the industry. A Steering Committee comprising representatives from then-Ministry of Tourism and Culture (MOTAC), Ministry of Finance, Ministry of Home Affairs, Ministry of International Trade and Industry, MyCEB, events-related associations and other relevant private sector stakeholders met monthly to review and problem-solve implementation issues on business tourism related activities. Notable issues resolved included immigration requirements for exhibition delegates and international speakers to improve Malaysia’s attractiveness. An inter-ministerial committee with representatives from all ministries was also set up in 2016 to coordinate the involvement of the government for the events to be hosted in Malaysia and minimise overlap of resources provided.

Providing an enabling environment

Capacity-building of the industry

In order to support the development of professional standards and skills training for event organisers, the Industry Partner Programme was established under MyCEB in 2011. This programme’s objectives were to provide access to market insights, encourage industry training and certification as well as facilitate co-operative marketing and promotions efforts. This activity was instrumental in ensuring a pipeline of capable event organisers who will be able to continue spearheading the industry.

Development of shell sites

Shell sites are required to host events such as gala dinners. Iconic shell sites can differentiate Malaysia from its competitors in other countries and provide a draw for organisers to host their events here. In Malaysia, no dedicated site existed as at 2010. Under this initiative, four shell sites were formally recognised comprising Central Market, Thean Hou Temple, Forest Research Institute of Malaysia (FRIM) and Maritime Centre Putrajaya.

Impact and Results

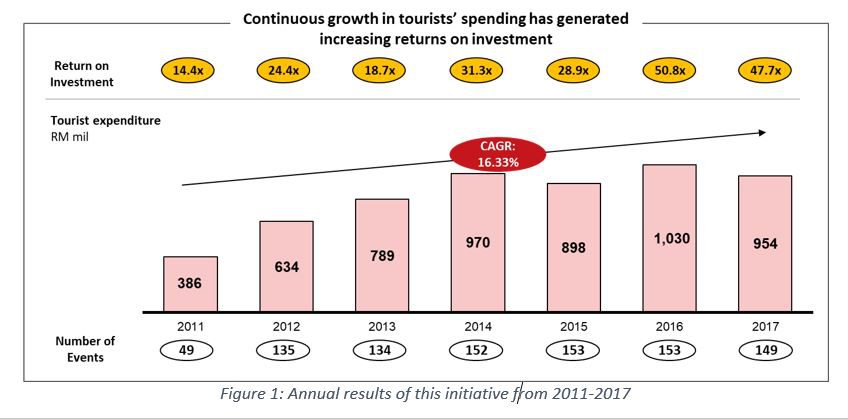

As a result of the concerted efforts spearheaded by MyCEB and supported by key stakeholders, business tourist expenditure grew at a CAGR of 16.3% from RM386 million since the launch of project in 2011 to RM954 million in 2017. The number of events secured annually also grew from only 49 in 2011 to reach 149 in 2017 with significant return of investment growth from 14.4 times in 2011 to a high of 47.7 times in 2017 (MyCEB, 2017).

In total, this EPP supported 2,013 events between 2010-2017 and attracted more than 943,146 international delegates to Malaysia, which translated to an estimated RM11.5 billion in economic impact to Malaysia. The share total arrivals from business tourism grew from 5% in 2009 to 7% in 2017 (ICCA, 2017).

Malaysia successfully secured and hosted various prestigious international events as exemplified below (list is non-exhaustive):

| No | Year | Notable events |

| 1 | 2011 |

|

| 2 | 2012 |

|

| 3 | 2013 |

|

| 4 | 2014 |

|

| 5 | 2015 |

|

| 6 | 2016 |

|

| 7 | 2017 |

|

| 8 | 2018 |

|

Hosting these international events increased Malaysia’s global recognition as a leading business tourism destination. In addition, this positively impacted various ancillary components such as accommodation, catering, logistics, events management as well as increasing the spillover effect for leisure tourism. In 2016, Malaysia was ranked 10th for business travel contribution in the World Travel and Tourism Council (WTTC)’s ranking. WTTC also reported that an analysis from Oxford Economics had shown that business travel spending in Malaysia was significantly higher than leisure travel and the average in the ASEAN region (WTTC, 2016).

As there was no dedicated body or initiative overseeing the development of this sector previously, the growth can be attributed to the success of this EPP under the Tourism NKEA.

Lessons Learnt and Recommendations

A key lesson learnt from this initiative is that it is highly imperative to have a dedicated body to spearhead the development of this sector and coordinate the various players from both the public and private sectors. Without a dedicated body to push the business tourism agenda forward, the initiative would not have been able to grow as rapidly. In addition, adequate funding support was critical to ensure continuous development as any reduction would directly impact the amount of subvention funds that could be provided, thus reducing the number and size of events that could be secured.

The involvement of private sector associations was also important to bridge the last mile in securing international organisers as well as provide the relevant expertise to ensure the success of the events. For example, the Malaysian Association of Convention and Exhibition Organisers and Suppliers (MACEOS) contributes to the development of this industry with its network and understanding of the industry, including the operations and execution of hosting international events. MyCEB plays a role to assist the association in market intelligence, bidding package and proposals to secure Malaysia as the host destination.

Another lesson learnt was that it was crucial to secure the support of other ministries and agencies. This is important as the involvement of the relevant ministry in charge, with the attendance of senior civil servants or the minister, serves as a draw for international event organisers. One of the ways to address this during the implementation phase was to create an inter-ministry coordination committee to coordinate the planning, securing, and organising of the business events hosted in Malaysia. This proved an important step in ensuring wider reach of MyCEB from only being under the purview Ministry of Tourism & Culture, to also work with various ministries which oversee policies such as industry development, the economy, immigration and trade.

Moving forward, PEMANDU Associates continues to have the view that a strong dedicated body to drive this sector is necessary, equipped with adequate funding and emphasising on recognised ROI, to support the growth of this industry. In addition, strong coordination and cooperation between the public and the private sectors is crucial to ensure the success of this industry.

Mindlab was initially intended to operate for a few years, but it succeeded in remaining relevant by focusing on current issues and always planning ahead of trends. Its reach across the government is unprecedented and has resulted in a major shift in how organisations think and work in Denmark.

Mindlab was initially intended to operate for a few years, but it succeeded in remaining relevant by focusing on current issues and always planning ahead of trends. Its reach across the government is unprecedented and has resulted in a major shift in how organisations think and work in Denmark. The adoption of the lab methodology globally has shown how labs help governments deep dive into specific subject areas and get their implementation programme right at the start to ensure the success of their transformation agenda. However, whilst the labs are an innovative tool and environment to chart out a true north for any transformation agenda, it is only an initial step of a transformation.

The adoption of the lab methodology globally has shown how labs help governments deep dive into specific subject areas and get their implementation programme right at the start to ensure the success of their transformation agenda. However, whilst the labs are an innovative tool and environment to chart out a true north for any transformation agenda, it is only an initial step of a transformation.

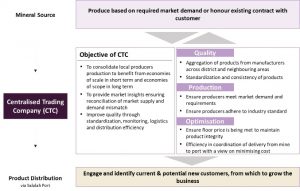

With a solid base in the electrical and electronics industry, steps were also taken to move up the value chain while closing the gaps in components, devices and services value chains along the way. Efforts were focused on three catalytic sub-sectors namely, electrical and electronics, chemicals, and machinery and equipment (M&E), with aerospace and medical devices identified as adjacent sub-sectors with high-growth potential as part of a 3+2 strategy. (Note: 3+2 refers to segments in E&E, chemicals and M&E plus aerospace and medical devices.)

With a solid base in the electrical and electronics industry, steps were also taken to move up the value chain while closing the gaps in components, devices and services value chains along the way. Efforts were focused on three catalytic sub-sectors namely, electrical and electronics, chemicals, and machinery and equipment (M&E), with aerospace and medical devices identified as adjacent sub-sectors with high-growth potential as part of a 3+2 strategy. (Note: 3+2 refers to segments in E&E, chemicals and M&E plus aerospace and medical devices.)