On the 31st of August 2021, Malaysia will celebrate 64 years of independence. Over the last two years, the usual fanfare associated with the occasion (among others) has been replaced with quieter celebrations at home under what seems to be a perpetual state of lockdown.

Why we assist SMEs to transform to unlock their full potential

Small-medium enterprises (SMEs) are the backbone of the Malaysian economy, accounting for 38.9% of Malaysia’s total GDP in 2019. Furthermore, share of SMEs exports to total exports in 2019 was 17.9% and SMEs employment comprised of 48.4% from Malaysia’s employment (i.e. 7.3 million persons in 2019)

The Global COVID-19 Index – From Vision to Reality

They say some of the best ideas come from the most unlikely of places. The Global COVID-19 Index (GCI) origin story is no different. The GCI’s inception came against a backdrop of a very difficult time for PEMANDU Associates. As an organization with most of our existing contracts abroad, COVID-19 hitting in full force meant calling all our colleagues back home in the interest of their health and welfare.

Reflections for 2020 – Surviving and Thriving in a Year of Disruptions

2020 arguably have been a disruptive year. From averaging one flight a week to meet clients and key decision makers around the world, I found myself grounded at home like the rest of the nation when the Covid-19 pandemic hit. PEMANDU Associates are accustomed to assisting clients near and far to introduce disruptive changes that bring big, fast, tangible results over the past decade; however even then we found ourselves literally grounded and facing the disruption just like everyone else.

As a start, PEMANDU Associates’ teams of consultants are often abroad to assist international governments in their quest to transform through national and economical agendas. In March, our team of consultants were in countries around the world such as St Lucia, Djibouti, Ethiopia and Oman when Malaysia announced the nationwide Movement Control Order (MCO). With the international borders being closed swiftly, it was logistically challenging to ensure our staff can return to Malaysia safely. As the MCO commenced, the reality of how drastically the economy and our way of life would be impacted set in. It was clear that the effect of the pandemic would be here to stay for at least the next 18-24 months and the word, crisis, is no longer an exaggeration of the state of things.

Throughout my career I have weathered numerous crises – from dealing with industrial strikes in my days in Sri Lanka to restructuring Malaysia Airlines, the crisis presented this time is no less harrowing. PEMANDU Associates being a firm that serves clients all around the world with our 8 Step Big Fast Results methodology, meant we travel internationally to carry out our engagements in person. The pandemic-induced restrictions mean this method of delivery is now curtailed. From our inception as the Delivery Unit for the Malaysian government to becoming a fully private consulting organisation, we are also accustomed to serving large and complex organisations that deal with competing priorities daily such as multinational corporations and governments. However, with 98.5% of business establishments in Malaysia being small-medium enterprises (SMEs) and contributing 38.9% to Malaysia’s GDP, it was clear those who require our help in crisis management in order to transform and pivot most urgently are SMEs. On top of that, the most essential tool in managing a crisis is to have clear, unbiased data and information in order to make informed and timely decisions to ensure survival. With multiple sources and rampant disinformation on the pandemic’s situation, it was challenging for governments to quickly react with effective measures and policies which in turn, impacts businesses and citizens to make corresponding decisions that could save both lives and livelihoods.

PEMANDU Associates itself immediately embarked on crisis management and action plan formulation. As a firm that prides itself on assisting clients to quickly transform with sound information guiding timely decisions, the first step was to establish a crisis management team with a nerve center so decisions made based on available information can be communicated clearly to stakeholders. By formally declaring a crisis, the CEO of the organisation sends a clear signal that things are no longer normal and that a series of decisions would need to be taken based on actual situation the company is in by calmly reviewing the options available. By modelling the three scenarios of optimistic, pragmatic and pessimistic on the organisation’s cashflow position, it provided a clear picture of reality which effective and rationale decision to be taken to manage the crisis. From there, a thorough and concrete action plan must be put in place for it to be operationalized. This must also be communicated transparently and regularly to the staff members in order to ensure calm and buy-in for the actions to come.

This practical approach has proven to be effective not just for PEMANDU Associates, but also our new clientele in the SME segment where they require most assistance in these challenging times. We assisted a number of SMEs to establish their crisis management and operationalize their action plans, which ultimately helped them to weather this storm and saved their businesses. As these interventions were carried out during the height of MCO, our team worked literally screen-by-screen with our SME clients to outline their crisis management and action plan, as well as the subsequent communication and townhall sessions with their staff – all fully virtually. This illustrates the possibility of applying our expertise in transformation for various types and sizes of organisations, debunking the myth that consulting is only for government and large corporations that can afford it. It was also an excellent catalyst to challenge us to work differently with international travel and in person engagements on hold.

As the priority is to ensure the safety and well-being of our staff members and clients, we had to pivot quickly in utilising virtual engagement tools to support our clients and ensure operations can continue. The challenge with adopting the virtual medium for us where working in proximity with clients has been the norm was to still ensure the effectiveness of support can be retained. One example was we successfully conducted workshops and webinars for clients in Zambia to support their capacity building in performance management by quickly modifying our way of working to include templates and regular check-ins, as well as utilising various collaborative classroom tools to ensure the brainstorming process and outcome normally through group discussions can be maintained. However, the largest challenge for us were to conduct our signature Labs entirely virtually! These engagements are usually 4-6 weeks long, with more than 100 persons gathering in the same space to work intensely to achieve tangible outcomes. For the National Postal and Courier Lab, we worked alongside the Malaysian Communications and Multimedia Commission to conduct a 3 week Lab where approximately 100 members from 30 agencies and companies worked completely virtually to detail out the way forward for courier and postal industries in the age of low-touch economy.

We are also happy to be able to support our local clients to quickly explore and capitalise on areas where Malaysia can take advantage of in the new normal. Earlier in the year we worked with the government of Malaysia to conduct a study on the practicality, costs and benefits of implementing electronic invoicing (eInvoicing). Unlike traditional invoicing methods which send physical invoices or even digitally in PDF, electronic invoices are in a standardized format, allowing seamless interoperability across different accounting systems and software. Aside from time and cost savings, eInvoicing reduces requirements for physical interaction which is timely given our current environment. This initiative also coincides with the significant increase in emphasis on eCommerce and has the potential to significantly boost our economy. We also looked at the type of strategies that Malaysia can explore to stay ahead of its competition in ensuring talent retention and competency building in the highly competitive space of digital outsourcing.Being able to prioritise with limited time and resource is also a hallmark of PEMANDU Associates in our work with governments and companies. It is in this vein that we were engaged to help Malaysia quickly capitalize on the fast-growing halal pharmaceutical and food services. Both of these sectors are in the spotlight given the increased awareness on halal alternatives for pharmaceuticals and vaccines with the Covid-19 pandemic, as well as the rise of popularity in delivery services for food and their compliance to halal requirements which has yet to be examined closely despite Malaysia’s leading position as a halal food producer and provider. We outlined the sectoral roadmap for both industries for the next 5 years with interventions in order for sector players to capitalize on these high-growth markets that are ripe for picking thanks for the pandemic, and are in the process of continuing to support the growth of other high-potential halal industries.

Whilst we are busy assisting and supporting our clients to capitalize on new areas of opportunity and growth, we have also taken a leap in innovating quickly through the creation and development of world’s first Global Covid-19 Index (GCI). GCI was born out of the Firm’s belief that timely and effective decision making must be based on objective and up-to-date data from our years of working with governments around the world. Developed in collaboration with Malaysia’s Ministry of Science, Technology and Innovation (MOSTI) and with inputs and qualified endorsement by the World Health Organisation (WHO), the Global COVID-19 Index (GCI) is designed to pull and analyse data from verified sources for 180 WHO Member States into a single source on a daily basis. This makes it a truly comprehensive index on the pandemic available. With Severity and Recovery Indices, GCI aggregates publicly available data and measures to provide daily updates which proved to be invaluable in assisting governments and businesses to make timely decisions on relaxing or tightening measures in order to balance public health and economic activities. We also built further on gleaning the insights and best practices from countries who have done well in the Global Pathfinder Report, where countries can capitalize on these useful lessons to handle the pandemic.

Although the GCI meant we had to embark on an area our organisation isn’t known for, it demonstrates that firms that are willing to pivot and innovate quickly can achieve the unexpected provided it is grounded in sound methodology and practice approaches which brings additional value to clients. This is also the reason why we are extremely honoured and proud that GCI was recently awarded the coveted Chairman’s Award at the 2020 WITSA Global ICT Excellence Awards, as the award recognizes useful technology applications that have made tangible difference in public service, enhance connectivity or boost profitability.

As this challenging year draws to a close, we are also grateful for the opportunities it has presented to catalyse innovation and to pivot quickly to adapt to the new normal, in order for us to continue making a difference through our transformative methodology for a wider group of clientele. It is our fervent hope that as 2021 begins, that we would be able to assist our clients as they undergo their transformation to capitalise on opportunities emerging in the new normal whilst we continue to innovate, adapt and ultimately, survive and emerging stronger.

Should We Worry About Food Security Amid the Covid-19 Crisis?

Alarming developments of the novel coronavirus have triggered a wave of panic buying across the globe. People have thronged to the supermarkets, clearing out shelves of food and fighting over basic hygiene necessities such as hand sanitisers and toilet paper,

Business Unusual in the Time of COVID-19

The COVID-19 outbreak has tourism industries around the world on their knees. The pandemic has delivered one of the hardest blows to the global tourism industry.

Transitioning A Government Agency Towards Revenue Generation for Sustainability

A Halal Facilitation Agency has high aspirations of becoming a global mover in the halal industry. Under its new leadership, the agency is looking beyond its government mandate to become a revenue

A CEO’s Guide to Managing Business In Crisis

The world is currently going through a serious global crisis, triggered by the COVID-19 pandemic. It is not just a health crisis. It is rapidly imploding into societal, economic and business crises. The critical question is: how long will this global

Optimising Public Sector Funds to Enhance Road Networks

Riddled with competing demands for road construction but with a shrinking budget, a Transcontinental Agency needed a strategy to deliver more roads, improve safety and optimise its

A Quick Win on Minimum Wage for the New Government

By Tengku Nurul Azian Tengku Shahriman, Executive Vice President & Partner

It is a sign of growth when countries start talking about raising the minimum wage. It demonstrates confidence in the resilience of the economy, and the need to prioritise the wellbeing of low-earning workers in the country. Malaysia had increased its minimum wage to RM1,200 earlier this year as part of a policy to address the country’s growing urban poverty and combat income inequality. However, it was met with outcry from some quarters who pointed out the lack of due warning and absence of a clear implementation programme for companies to adequately prepare themselves ahead of the wage hike. Others raised the issue that a RM100 increase was still not enough to cover basic expenses.

Malaysia is now under a different government, with a new Prime Minister at its helm. There is an opportunity here for the new administration to pick up where the former left off and turn the minimum wage increase into a positive and actionable policy. But first, it is important to understand the argument around minimum wage in its entirety, from its impact on the economy to how businesses can cope with the increase.

1. Why raise the minimum wage at all?

Setting a minimum wage protects workers against unduly low pay. It allows the government to set the terms of employment and working conditions.[1] With the right policies in place, the minimum wage can be a tool for the government to overcome poverty and reduce income inequality.

Malaysia first set a minimum wage in 2013. This was done as part of a larger programme aimed at ensuring inclusivity and boosting the economy to high-income status. It was calculated based on a variety of factors: the poverty line, productivity growth, consumer price index, unemployment rate (actual, region), average wage per household and medium wage. At the time, the wage was estimated to benefit about 27% of workers nationwide.

By right, the minimum wage should reflect increases in the cost of living to ensure that workers can afford to buy basic necessities. However, the minimum wage has only been increased a couple of times since its introduction in 2013 – first in 2016 when it was raised to RM1,000 a month, to RM1,050 a month, and then to RM1,100 a month in 2019. This year would be the fourth time.

This mismatch between the minimum wage and rising cost of living has had the biggest impact on low-income households. Since 2014, the monthly income of the bottom 40% (B40) has grown by 5.8% annually – but after accounting for the increase in the cost of living, the growth is actually at around 3.8%.[2] At the same time, household expenditure grew at a faster pace of 6%, leaving these households with very little money to spend.[3]

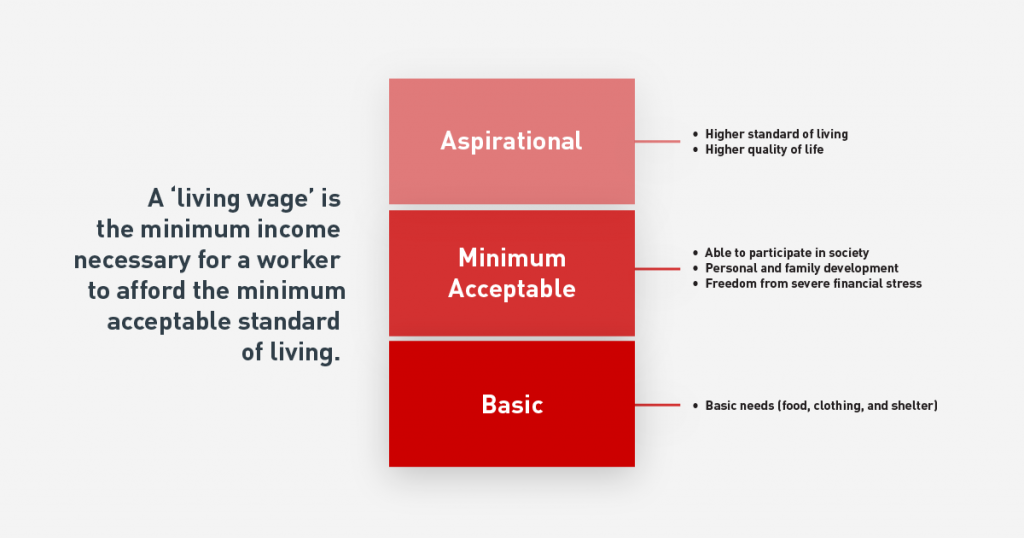

In 2018, Bank Negara Malaysia (BNM) introduced the concept of a ‘living wage’[4]. Defined as a wage level that could afford the minimum acceptable living standard, a living wage would allow individuals to sustain a decent standard of living beyond just the basic necessities such as food, clothing and shelter. It should also provide for personal and family development, social participation – such as occasionally being able to purchase gifts for family members – and financial security.

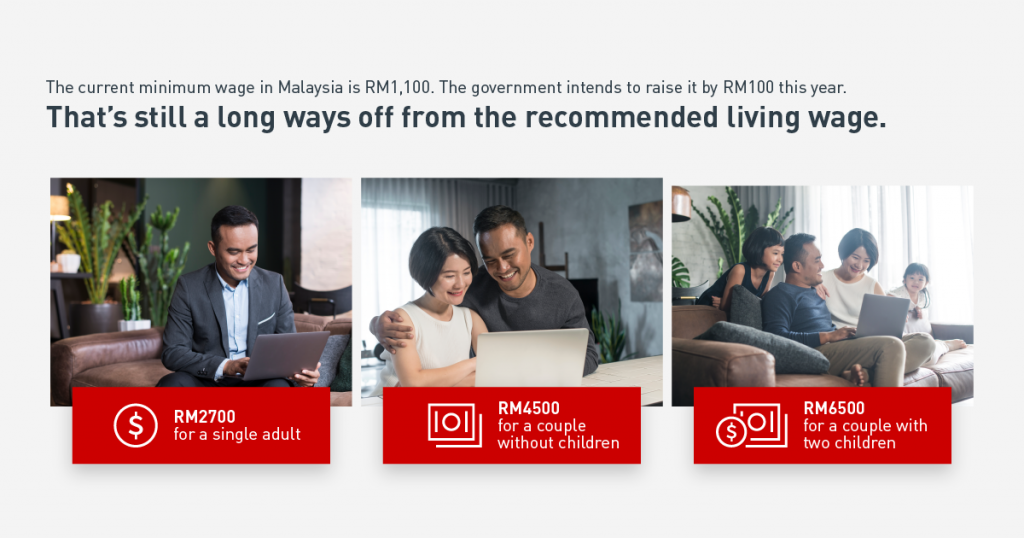

The report calculated the estimated living wage for Kuala Lumpur as follows:

- A single adult, renting a room and frequently using public transport, would require RM2,700 a month to maintain the minimum acceptable living standard in the city

- A couple with no children renting a one-bedroom apartment would require RM4,500 a month

- Families with two children would require RM6,500

Even with the RM100 increase, the current minimum wage of RM1,200 is still much lower than Bank Negara’s projected living wage.

To compare, the monthly income in 2016 for B40 households living in Kuala Lumpur was reported by the Statistics Department as RM5,344[5] – lower than the estimated living wage of RM6,500. This has made it challenging for such families to afford basic necessities, much less a home, car or other consumer goods, causing many to look for supplementary sources of income. More people are resorting to working two jobs or deriving income from a side business just to make ends meet, contributing to the rise of Malaysia’s gig economy.[6]

Increasing the minimum wage can provide these communities with a safety-net, allowing them to afford more than just the absolute basic necessities. It is also important to ensure that the minimum wage stays relevant. This can be done by holding an annual review, checking the set wage against current cost of living and overall health of the economy, and make the appropriate adjustments.

2. How will the increase impact the economy?

The biggest risk raised is that the wage increase would be set too far above the rate that employers can afford to pay their employees, forcing them to lay off workers if they can’t offset that cost in some other way.

However, research suggests otherwise. Studies have found that increasing the minimum wage is often beneficial. The University of Washington has been studying the impact of raising the minimum wage in Seattle on its economy; a recent report shows that low-income workers were better off as a whole after the increase.[7]

This is no different for developing countries. North Macedonia underwent a bold reform of its minimum wage system in 2017, increasing the minimum by 19% and introduced the same wage in all sectors. The International Labour Organisation (ILO) found that it was successful in reducing wage inequality without negative impact; after the reform, only 4.3% of wage earners were in the low wage category (compared to 14.7% before the reform), and the bottom 10% received a share of 4.6% of all wages in the country which is well above the European Union’s average of 3.6%.[8]

One of the challenges ahead for the new government will be to revive the national economy. Malaysia is currently facing various threats, from the Covid-19 outbreak to international trade wars, and is coming off the back of a slow fourth quarter growth. This is compounded by the recent political uncertainty which has caused the Malaysian stock market to plummet. One way to spur the economy is by increasing purchasing power of the rakyat; this can be done by increasing wages and thus providing them with a little more disposable income. It could also boost overall purchasing power and contribute to household consumption. [9] Higher basic wages to the low wage earners could boost the income of small- and micro-businesses in Malaysia. Even modest rises in the national minimum wage could make a big difference to disposable income.

3. What does this mean for businesses?

A gradual increase in minimum wage provides the opportunity for business leaders to review their operations and make the necessary adjustments or optimisation to balance the higher cost of employment. It may even stimulate a larger transformation in the organisation’s strategy or operations that will make their business stronger in the long run.

For businesses that might be impacted by the raise, preparation is key. Here are some ways they can ready themselves:

- Figure out how much the increase is going to cost – Are there business expenses that can be reduced? Is the budget flexible enough to accommodate redistribution of funds? A segmented P&L exercise can help companies determine at a very granular level which areas are making a loss, and which are turning a profit. This will enable companies to see if they can accommodate a minimum wage increase.

- Look for ways to increase productivity – Is the business being as efficient as possible? Are there areas that can be improved? Setting a strategic direction and ruthlessly prioritising the most productive and efficient initiatives will help to ensure greater focus overall and maximise the trend and speed of delivery. Set key performance indicators and monitor them religiously to ensure that progress is being done.

- Leverage on technology –What manual activities in the day-to-day operations can be automated? Are there any processes that can be upgraded by using new technological innovations? The idea here is to use technology not just to replicate an existing service in digital form but to transform that service into something significantly better.

A minimum wage increase isn’t a death sentence for businesses. Rather, it can be an opportunity for companies to transform their organisation into one that is agile, productive and digitally-forward.

4. How can the government manage the shock to the economy?

When the RM1,200 minimum wage was first announced late last year, businesses were taken by surprise by the increase and resistant to any change to the minimum wage. Representing one of the major industries in Malaysia, the Federation of Malaysian Manufacturers has stated that the industry is not against the increase in the minimum wage, but there should be a “clear and certain roadmap for the phases of increase, including the areas of coverage, to provide clarity and certainty to the business community for their respective budgeting and planning purposes”[10].

As with any socio-economic policy, it is important that both the public and the private sectors are aware ahead of time about what is being planned and how it would be rolled out, as well as any support that would be available to ease its implementation. This could be done by publishing a public roadmap, followed by an annual review of its implementation and effectiveness.

To raise or not to raise?

Over 20% of Malaysian households earn below the relative poverty line.[11] Increasing the minimum wage – perhaps even to over RM1,200 – is a good idea and one that has the potential to help a lot of B40 communities. However, any increases to the minimum wage should be done gradually and openly.

Much of the resistance to raising the minimum wage was due to the suddenness and perceived lack of planning on a key socio-economic issue as opposed to the increase itself. A clear implementation plan, with a condition to review the set minimum wage each year to ensure its relevance given the current economic landscape, would help to clarify the issue and let the public know what to expect.

This is an opportunity for the new administration to take the lead on a popular issue and work together with both businesses and unions to deliver a truly transformative policy.

[1] International Labour Organisation (ILO), 2020

[2] ‘The Living Wage: beyond making ends meet’, Bank Negara Malaysia, 2018

[3] New Straits Times, 2018

[4] ‘The Living Wage: beyond making ends meet’, Bank Negara Malaysia, 2018

[5] The Star, 2019.

[6] Ibid.

[7] Evans School of Public Policy & Governance, 2020

[8] ILO, 2019

[9] The Edge Markets, 2019

[10] The Edge Markets, 2020

[11] The Star, 2019